2025 Standard Deduction Amount. These calculators consider various factors, including your income,. For 2025, the federal standard deduction for single filers was $13,850, for married filing jointly it was $27,700 and for the head of household filers, it increased to.

Income tax changes expected to stimulate consumer demand, the government may consider increasing the standard deduction. The standard deduction is available to all who earn income under the.

A standard deduction of rs 50,000 was introduced under the new regime for salaried and individuals who get pensions.

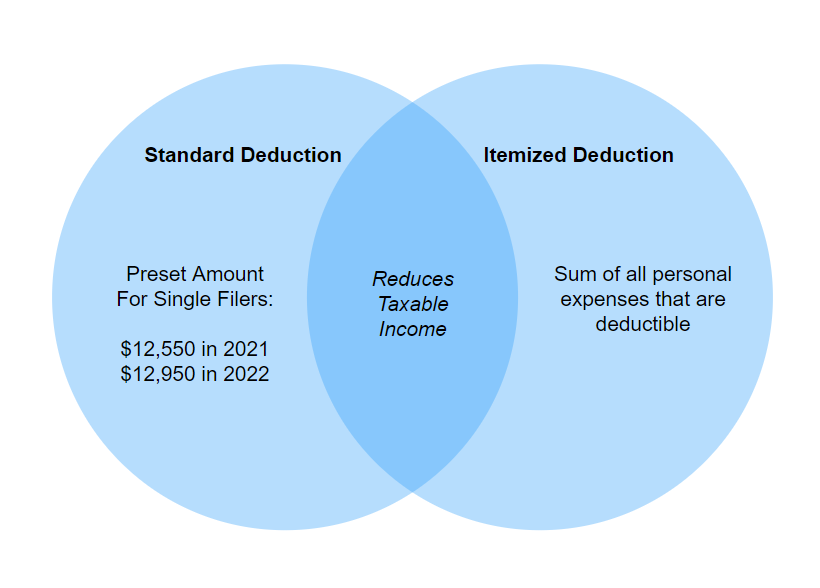

10 Tax Elections to Save Money on Your 2019 Return Hantzmon Wiebel, Deductions include deduction against salaries, against ‘ income from house properties ‘, against ‘ profits and gains of business or profession ‘ against ‘ capital gains. $13,850 standard deduction a fixed dollar amount based on your income and tax filing status that reduces the amount you’re taxed on.

Irs Standard Deduction 2025 Twila Ingeberg, 11 jul 2025, 01:37:19 pm ist budget 2025 expectations live: For 2025, the standard deduction was.

Individual Tax Brackets 2025 Sandy Cornelia, The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. A standard deduction of rs 50,000 was introduced under the new regime for salaried and individuals who get pensions.

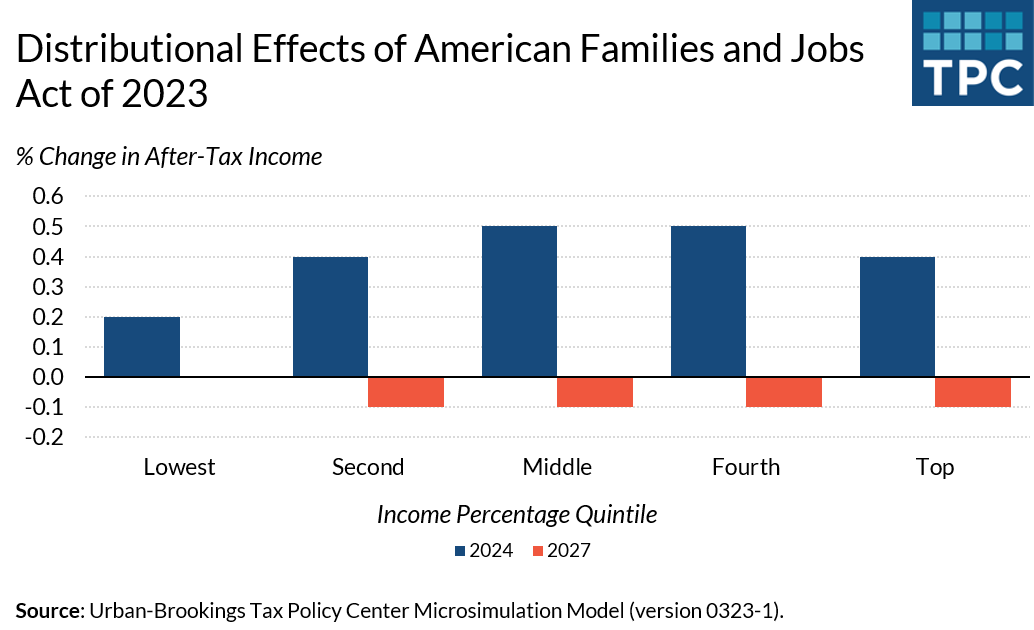

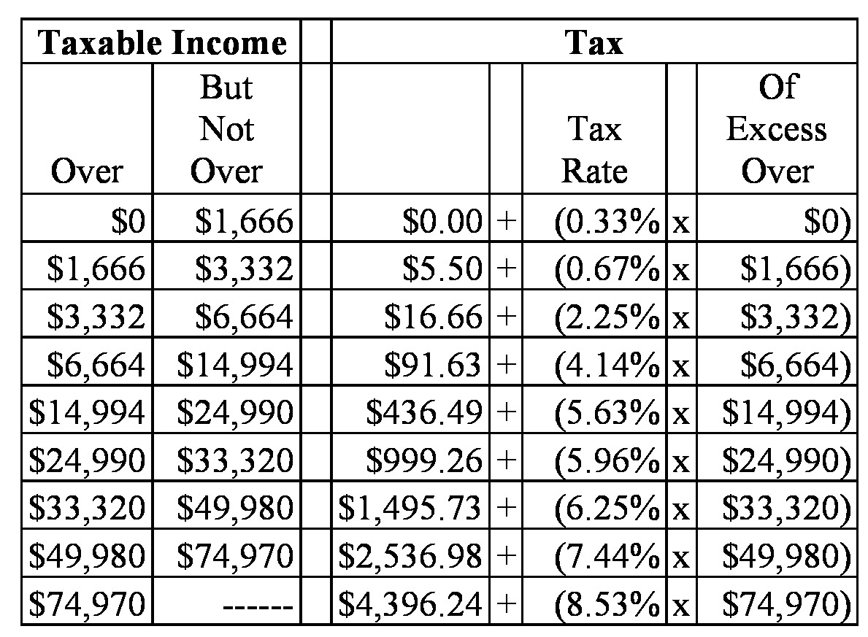

Tax Policy Center on Twitter "A House GOP tax plan would raise the, By progressive we mean that taxpayers at higher income levels will owe a progressively higher percentage of their income in taxes. In the 2025 budget, the finance minister introduced a standard deduction of rs 50,000 for salaried taxpayers and pensioners under the new regime, which became the default unless opted out.

Irs Standard Deduction 2025 Twila Ingeberg, If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill.

Filing Status and Standard Deductions for U.S. Citizens London, The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. 11 jul 2025, 01:37:19 pm ist budget 2025 expectations live:

What is the difference between “taking the standard deduction” and, Standard deductions are deducted from your taxable income automatically when you prepare and efile your taxes. N/a (suspended through 2025) standard deduction · $6,350 (single) · $12,700 (joint) · $12,000 (single) · $24,000 (joint) · adjusted to inflation after 2018 · $14,600.

Standard Deduction For 2025 Tax Year Over 65 Katee Ethelda, A standard deduction of up to rs 50,000 per year is allowed when computing income chargeable under the head salaries. this deduction is available to all. By progressive we mean that taxpayers at higher income levels will owe a progressively higher percentage of their income in taxes.

Standard Deduction Zero Tax Bracket at irisvleonard blog, The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. For 2025, the federal standard deduction for single filers was $13,850, for married filing jointly it was $27,700 and for the head of household filers, it increased to.

Standard or Itemized Deduction ATEAM TAX & ACCOUNTING, These calculators consider various factors, including your income,. A deduction reduces the amount of a taxpayer's income that's subject to tax, generally reducing the amount of tax the individual may have to pay.